根据2013年2月13日第433号规则注册编号333-186617提交的发行人免费书面招股说明书

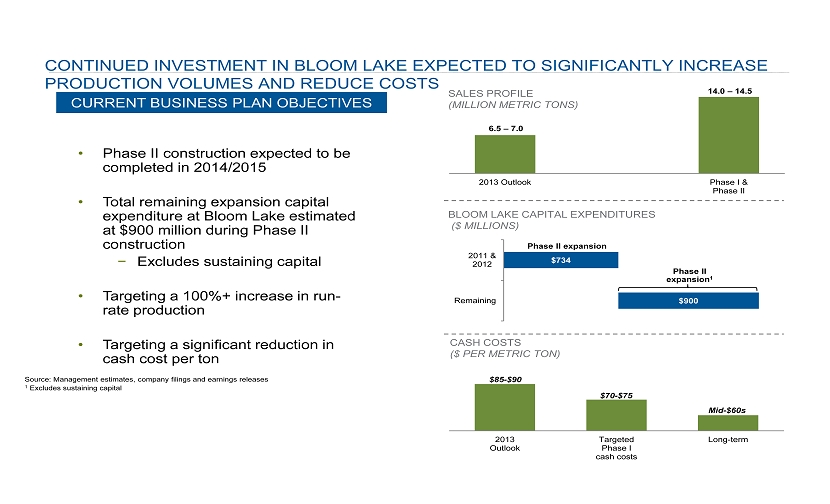

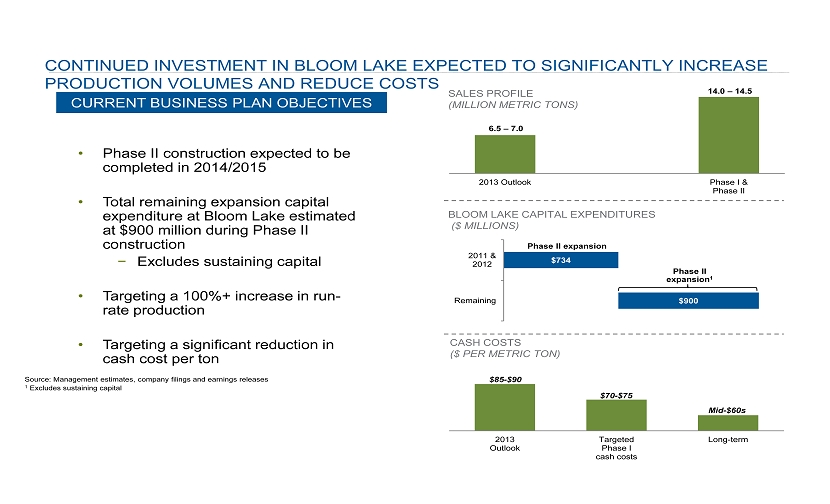

2013年展望目标第一阶段现金成本BLOOM LAKE的长期持续投资预计将显著增加产量并降低成本销售概况(百万公吨)管理的估计,公司文件和盈利释放1不包括维持资本BLOOM LAKE资本支出(百万美元)现金成本(美元/吨)2013年展望期和二期85 - 90美元•二期建设预计将在2014/2015完成•布鲁姆湖总剩余的扩张资本支出估计为9亿美元在二期建设−排除维持资本•目标+增加运行- 100%生产•目标显著减少现金成本吨$734 $900剩余2011年和2012年$70 - 75中期- 60美元二期扩张二期扩张1当前业务计划目标6.5 - 7.0 14.0 - 14.5

前瞻性声明的警示性说明

This document contains certain “forward-looking” statements within the safe harbor protections of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by the use of predictive, future-tense or forward-looking terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “intends,” “may,” “will” or similar terms. These statements speak only as of the date of this document and we undertake no ongoing obligation, other than that imposed by law, to update these statements. These statements relate to, among other things, our intent, belief or current expectations of our directors or our officers with respect to: our future financial condition; results of operations or prospects; estimates of our economic iron ore and coal reserves; our business and growth strategies; and our financing plans and forecasts. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those contained in or implied by the forward-looking statements as a result of various factors, some of which are unknown, including, without limitation: uncertainty or weaknesses in global economic conditions, including downward pressure on prices, reduced market demand and any slowing of the economic growth rate in China; trends affecting our financial condition, results of operations or future prospects, particularly the continued volatility of iron ore and coal prices; our ability to successfully integrate acquired companies into our operations and achieve post-acquisition synergies, including without limitation, Cliffs Quebec Iron Mining Limited (formerly Consolidated Thompson Iron Mining Limited, or Consolidated Thompson); our ability to successfully identify and consummate any strategic investments and complete planned divestitures; the outcome of any contractual disputes with our customers, joint venture partners or significant energy, material or service providers or any other litigation or arbitration; the ability of our customers and joint venture partners to meet their obligations to us on a timely basis or at all; our ability to reach agreement with our iron ore customers regarding modifications to sales contract pricing escalation provisions to reflect a shorter-term or spot-based pricing mechanism; the impact of price-adjustment factors on our sales contracts; changes in sales volume or mix; our actual economic iron ore and coal reserves or reductions in current mineral estimates, including whether any mineralized material qualifies as a reserve; the impact of our customers using other methods to produce steel or reducing their steel production; events or circumstances that could impair or adversely impact the viability of a mine and the carrying value of associated assets; the results of prefeasibility and feasibility studies in relation to projects; impacts of existing and increasing governmental regulation and related costs and liabilities, including failure to receive or maintain required operating and environmental permits, approvals, modifications or other authorization of, or from, any governmental or regulatory entity and costs related to implementing improvements to ensure compliance with regulatory changes; our ability to cost effectively achieve planned production rates or levels; uncertainties associated with natural disasters, weather conditions, unanticipated geological conditions, supply or price of energy, equipment failures and other unexpected events; adverse changes in currency values, currency exchange rates, interest rates and tax laws; availability of capital and our ability to maintain adequate liquidity and successfully implement our financing plans; our ability to maintain appropriate relations with unions and employees and enter into or renew collective bargaining agreements on satisfactory terms; risks related to international operations; availability of capital equipment and component parts; the potential existence of significant deficiencies or material weakness in our internal control over financial reporting; problems or uncertainties with productivity, tons mined, transportation, mine-closure obligations, environmental liabilities, employee-benefit costs and other risks of the mining industry; and other risks described in our reports filed with the SEC. These factors and the other risk factors described in this document, including the exhibits attached hereto, are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. The forward-looking statements contained in this document are made as of the date of this document and, accordingly, are subject to change after such date. Except as may be required by applicable securities laws, Cliffs does not undertake any obligation to update or revise any forward-looking statements contained in this document, whether as a result of new information, future events or otherwise.

公司已就本通讯所涉及的发行向皇冠体育官网证券交易委员会提交了一份注册声明(包括招股说明书)。在您投资之前,您应该阅读注册声明中的招股说明书以及发行人向皇冠体育官网证券交易委员会提交的其他文件,以获得有关发行人和本次发行的更完整信息。您可以通过访问SEC网站www.sec.gov上的EDGAR免费获得这些文件。或者,副本可从摩根大通证券有限责任公司获得,地址:摩根大通证券有限责任公司,地址:Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, 866-803-9204;或拨打866-500-5408咨询美林证券(Merrill Lynch, Pierce, Fenner & Smith Incorporated)。