©2024 Cleveland-Cliffs Inc.版权所有。CLEVELAND-CLIFFS INC .)投资者介绍会,2024年10月8日

© 2024 Cleveland-Cliffs Inc. All Rights Reserved.2 This presentation has been prepared by Cleveland-Cliffs Inc. (the “Company,” “Cliffs,” “Cleveland-Cliffs,” “we,” or “us”) for the exclusive use of the party to whom the Company delivers this presentation. This presentation is the property of and contains the proprietary confidential in formation of the Company and is being made to you solely for your information and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. By participating in this presentation, you agree to be bound by these terms. This presentation is for information purposes only, and the Company does not make any representation or warranty, either express or implied, as to the accuracy, completeness or reliability of the information contained in this presentation. Acceptance of this presentation further constitutes your acknowledgement and agreement that none of the Company, the Company’s direct and indirect equity holders and their respective affiliates, directors, officers, employees, partners, members, controlling persons, agents or advisers (i) makes any express or implied representation or warranty as to the accuracy, reliability, reasonableness or completeness of the information contained herein and (ii) shall bear any responsibility or have any liability to the recipient or its representatives relating to or arising from the information contained herein or any omissions from such information, or any other written or oral communication transmitted to any interested party in the course of its evaluation of the Company or any potential transaction involving the Company. The Notes (as defined below) discussed herein have not been and will not be registered under the U.S. Securities Act of 1933 (as amended, the “Act”), or any state securities laws or the laws of any foreign jurisdiction. The Notes are being offered only to persons reasonably believed to be “qualified institutional buyers” pursuant to Rule 144A under the Act and to non U.S. persons outside the United States in reliance on Regulation S under the Act. Accordingly, this document is being provided only to persons that are reasonably believed to be “qualified institutional buyers,” as defined in Rule 144A under the Act, or that are non U.S. persons outside the United States. By accepting this presentation, you will be deemed to represent that you are either a qualified institutional buyer or a non U.S. person outside the United States. The Notes have not been approved or disapproved by the U.S. Securities and Exchange Commission, or any other securities regulating body or agency, nor has any such authority, commission, or body passed on the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. The Notes will be subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Act and applicable state securities laws pursuant to registration or exemption therefrom. Investors should be aware that they may be required to bear the financial risks of an investment in the Notes for an indefinite period of time. The Notes will not be listed on any securities exchange or automated quotation system, and there is no obligation on the part of any person to make a market for the notes. To the extent any information is inconsistent, this presentation is superseded by and should be read in conjunction with the offering memorandum for the notes discussed herein. Offers to sell and solicitations of offers to buy the Notes, as applicable, are made only by, and the information herein must be read in conjunction with, the preliminary offering memorandum to be provided, as such offering memorandum may be further supplemented, amended or replaced by a final offering memorandum (as so supplemented, amended or replaced, the “Offering Memorandum”). Information contained herein does not purport to be complete and is subject to the same qualifications and assumptions, and should be considered by investors only in light of the same warnings, lack of assurances and representations and other precautionary matters, as disclosed in the Offering Memorandum. This presentation includes certain non-GAAP financial measures of the Company, including Adjusted EBITDA about the Company and Free Cash Flow, and certain non-IFRS financial measures of Stelco Holdings Inc. (“Stelco”), including Adjusted EBITDA. The Company uses Adjusted EBITDA and believes that investors, lenders and other external users of its financial statements use Adjusted EBITDA to assess and compare the Company's operating performance to other companies in the steel industry. In addition, the Company’s management believes Adjusted EBITDA is a useful measure to assess the earnings power of the business without the impact of capital structure and can be used to assess our ability to service debt and fund future capital expenditures in the business. The Company uses Free Cash Flow and believes it is an important measure to assess the cash generation available to service debt, strategic initiatives or other financing activities. Non-GAAP and non-IFRS financial measures such as Adjusted EBITDA and non-GAAP financial measures such as Free Cash Flow should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP or IFRS. For a reconciliation of non-GAAP financial measures of the Company and non-IFRS measures of Stelco to financial measures prepared in accordance with GAAP or IFRS, as applicable, please refer to the Appendix of this presentation. The Company expressly disclaims any and all liability relating to or resulting from the use of this presentation. In addition, the information contained in this presentation is as of the date hereof, and the Company has no obligation to update such information, including in the event that such information becomes inaccurate. This presentation contains estimates and information concerning our industry, including market position and the size and growth rates of the markets in which we participate, that are based on industry publications and reports or other publicly available information. Industry surveys and publications generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy and completeness of the included information. We have not independently verified this third-party information. LEGAL DISCLAIMER These materials are not to be printed, downloaded or distributed. These materials are only available to QIBs and non-US persons

© 2024 Cleveland-Cliffs Inc. All Rights Reserved.3 This presentation contains statements that constitute "forward-looking statements" within the meaning of the federal securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry or our businesses, are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward-looking statements are the following: continued volatility of steel, iron ore and scrap metal market prices, which directly and indirectly impact the prices of the products that we sell to our customers; uncertainties associated with the highly competitive and cyclical steel industry and our reliance on the demand for steel from the automotive industry; potential weaknesses and uncertainties in global economic conditions, excess global steelmaking capacity, oversupply of iron ore, prevalence of steel imports and reduced market demand; severe financial hardship, bankruptcy, temporary or permanent shutdowns or operational challenges of one or more of our major customers, key suppliers or contractors, which, among other adverse effects, could disrupt our operations or lead to reduced demand for our products, increased difficulty collecting receivables, and customers and/or suppliers asserting force majeure or other reasons for not performing their contractual obligations to us; risks related to U.S. government actions with respect to Section 232 of the Trade Expansion Act of 1962 (as amended by the Trade Act of 1974), the United States-Mexico-Canada Agreement and/or other trade agreements, tariffs, treaties or policies, as well as the uncertainty of obtaining and maintaining effective antidumping and countervailing duty orders to counteract the harmful effects of unfairly traded imports; impacts of existing and increasing governmental regulation, including potential environmental regulations relating to climate change and carbon emissions, and related costs and liabilities, including failure to receive or maintain required operating and environmental permits, approvals, modifications or other authorizations of, or from, any governmental or regulatory authority and costs related to implementing improvements to ensure compliance with regulatory changes, including potential financial assurance requirements, and reclamation and remediation obligations; potential impacts to the environment or exposure to hazardous substances resulting from our operations; our ability to maintain adequate liquidity, our level of indebtedness and the availability of capital could limit our financial flexibility and cash flow necessary to fund working capital, planned capital expenditures, acquisitions, and other general corporate purposes or ongoing needs of our business, or to repurchase our common shares; our ability to reduce our indebtedness or return capital to shareholders within the currently expected timeframes or at all; adverse changes in credit ratings, interest rates, foreign currency rates and tax laws; the outcome of, and costs incurred in connection with, lawsuits, claims, arbitrations or governmental proceedings relating to commercial and business disputes, antitrust claims, environmental matters, government investigations, occupational or personal injury claims, property-related matters, labor and employment matters, or suits involving legacy operations and other matters; supply chain disruptions or changes in the cost, quality or availability of energy sources, including electricity, natural gas and diesel fuel, critical raw materials and supplies, including iron ore, industrial gases, graphite electrodes, scrap metal, chrome, zinc, other alloys, coke and metallurgical coal, and critical manufacturing equipment and spare parts; problems or disruptions associated with transporting products to our customers, moving manufacturing inputs or products internally among our facilities, or suppliers transporting raw materials to us; the risk that the cost or time to implement a strategic or sustaining capital project may prove to be greater than originally anticipated; our ability to consummate any public or private acquisition transactions and to realize any or all of the anticipated benefits or estimated future synergies, as well as to successfully integrate any acquired businesses into our existing businesses; uncertainties associated with natural or human-caused disasters, adverse weather conditions, unanticipated geological conditions, critical equipment failures, infectious disease outbreaks, tailings dam failures and other unexpected events; cybersecurity incidents relating to, disruptions in, or failures of, information technology systems that are managed by us or third parties that host or have access to our data or systems, including the loss, theft or corruption of sensitive or essential business or personal information and the inability to access or control systems; liabilities and costs arising in connection with any business decisions to temporarily or indefinitely idle or permanently close an operating facility or mine, which could adversely impact the carrying value of associated assets and give rise to impairment charges or closure and reclamation obligations, as well as uncertainties associated with restarting any previously idled operating facility or mine; our level of self-insurance and our ability to obtain sufficient third-party insurance to adequately cover potential adverse events and business risks; uncertainties associated with our ability to meet customers' and suppliers' decarbonization goals and reduce our greenhouse gas emissions in alignment with our own announced targets; challenges to maintaining our social license to operate with our stakeholders, including the impacts of our operations on local communities, reputational impacts of operating in a carbon-intensive industry that produces greenhouse gas emissions, and our ability to foster a consistent operational and safety track record; our actual economic mineral reserves or reductions in current mineral reserve estimates, and any title defect or loss of any lease, license, easement or other possessory interest for any mining property; our ability to maintain satisfactory labor relations with unions and employees; unanticipated or higher costs associated with pension and other post- employment benefit obligations resulting from changes in the value of plan assets or contribution increases required for unfunded obligations; uncertain availability or cost of skilled workers to fill critical operational positions and potential labor shortages caused by experienced employee attrition or otherwise, as well as our ability to attract, hire, develop and retain key personnel; the amount and timing of any repurchases of our common shares; potential significant deficiencies or material weaknesses in our internal control over financial reporting; the risk that the proposed transaction with Stelco may not be consummated; the risk that a transaction with Stelco may be less accretive than expected, or may be dilutive, to Cliffs’ earnings per share, which may negatively affect the market price of Cliffs’ common shares; the risk that adverse reactions or changes to business or regulatory relationships may result from the announcement or completion of the proposed transaction; the possibility of the occurrence of any event, change or other circumstance that could give rise to the right of one or both of Cliffs or Stelco to terminate the transaction agreement between the two companies, including, but not limited to, the companies’ inability to obtain necessary regulatory approvals; the risk of shareholder litigation relating to the proposed transaction that could be instituted against Stelco, Cliffs or their respective directors and officers; the possibility that Cliffs and Stelco will incur significant transaction and other costs in connection with the proposed transaction, which may be in excess of those anticipated by Cliffs; the risk that the financing transactions to be undertaken in connection with the proposed transaction may have a negative impact on the combined company’s credit profile, financial condition or financial flexibility; the possibility that the anticipated benefits of the proposed acquisition of Stelco are not realized to the same extent as projected and that the integration of the acquired business into our existing business, including uncertainties associated with maintaining relationships with customers, vendors and employees, is not as successful as expected; the risk that future synergies from the acquisition of Stelco may not be realized or may take longer than expected to achieve; the possibility that the business and management strategies currently in place or implemented in the future for the maintenance, expansion and growth of the combined company’s operations may not be as successful as anticipated; the risk associated with the retention and hiring of key personnel, including those of Stelco; the risk that any announcements relating to, or the completion of, the proposed transaction could have adverse effects on the market price of Cliffs' common shares; and the risk of any unforeseen liabilities and future capital expenditures related to the proposed transaction. For additional factors affecting the business of Cliffs, refer to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2023, and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2024 and June 30, 2024, and our other filings with the U.S. Securities and Exchange Commission. For additional factors affecting the business of Stelco, refer to Stelco's management's discussion and analysis of financial condition and results of operations of Stelco for the three and six months ended June 30, 2024 and 2023 and for the years ended December 31, 2023 and 2022 and in the annual information form of Stelco dated February 21, 2024 for the year ended December 31, 2023. FORWARD-LOOKING STATEMENTS

©2024 Cleveland-Cliffs Inc.总部位于北美的领先钢铁生产商,专注于增值钢板产品,特别是汽车行业最近宣布收购Stelco,为其足迹增加了成本最低的扁钢生产商,并使终端市场/客户群多样化。与工会员工建立了强大的合作伙伴关系,并与usw代表的员工完成了交易,从铁矿石开采、颗粒生产和直接还原铁完全整合。通过初级炼钢和下游精加工,冲压,模具和管材进行铁废料加工的强大资产负债表,更加关注去杠杆化,并证明了收购后快速去杠杆化的能力三个增值增长项目在政府支持下,预计将为年度EBITDA贡献超过6亿美元

公司收购

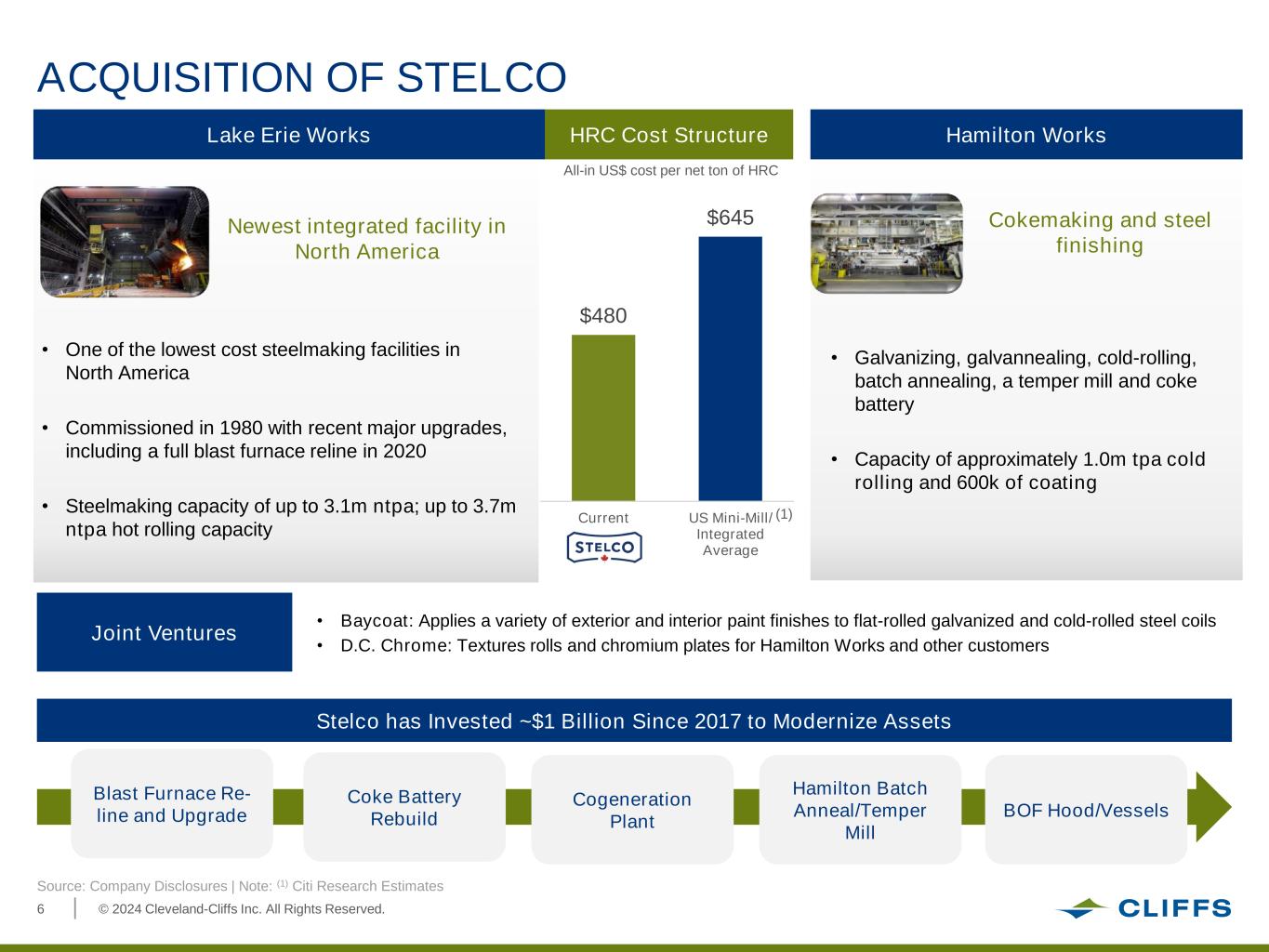

©2024 Cleveland-Cliffs Inc.•镀锌、镀锌、冷轧、批量退火、回火机和焦炭电池•冷轧产能约为100万吨/年,60万吨/年涂层伊利湖工厂•北美成本最低的炼钢设施之一•于1980年投入使用,最近进行了重大升级,包括2020年的全套高炉线•炼钢产能高达310万吨/年;高达3.7m吨/年热轧产能汉密尔顿工程合资公司•Baycoat:适用于各种外部和内部油漆饰面平轧镀锌和冷轧钢卷•dc铬:为汉密尔顿工厂和其他客户提供的轧辊和铬板炼焦和钢材精加工北美最新的综合设施Stelco自2017年以来已投资约10亿美元用于资产现代化高炉改线和升级焦炭电池改造热电联产厂汉密尔顿批量退火/回火厂转炉罩/容器HRC成本结构480美元645美元目前皇冠体育官网小型轧机/综合HRC每吨净成本(1)来源:公司披露|注:(1)花旗研究估算

©2024 Cleveland-Cliffs Inc.7预计算运营足迹Hibbing Taconite矿山(拥有85.3%)高炉/转炉炼钢业务铁矿石矿山和球团厂煤/焦炭生产设施EAF资产直接还原铁精加工设施下游资产废料处理设施Stelco设施北岸米诺卡联合Taconite ConshohockenSteelton Bowling Green MI Tilden Burns Harbor Windsor和Ontario FPT密歇根州托莱多HBI工厂MansfieldWalbridge FPT俄亥俄州皇冠体育哥伦布ZanesvilleCoshocton Middletown PrincetonRockport Burns Harbor Plate & Gary Plate皇冠体育克利夫斯总部(皇冠体育)迪尔伯恩新卡莱尔哥伦布Monessen Butler密歇根州WV KY PA俄亥俄州安大略省迪尔伯恩汉密尔顿工厂伊利湖工厂纽约州FPT安大略Riverdale印第安纳港Coatesville沃伦WI IL MN Hibbing来源:公司文件网站未显示:阿拉巴马州(Sylacauga下游资产),佛罗里达州(FPT废料处理设施),北卡罗来纳州(皮埃蒙特下游资产),田纳西州(FPT废料处理设施,皇冠体育下游资产)

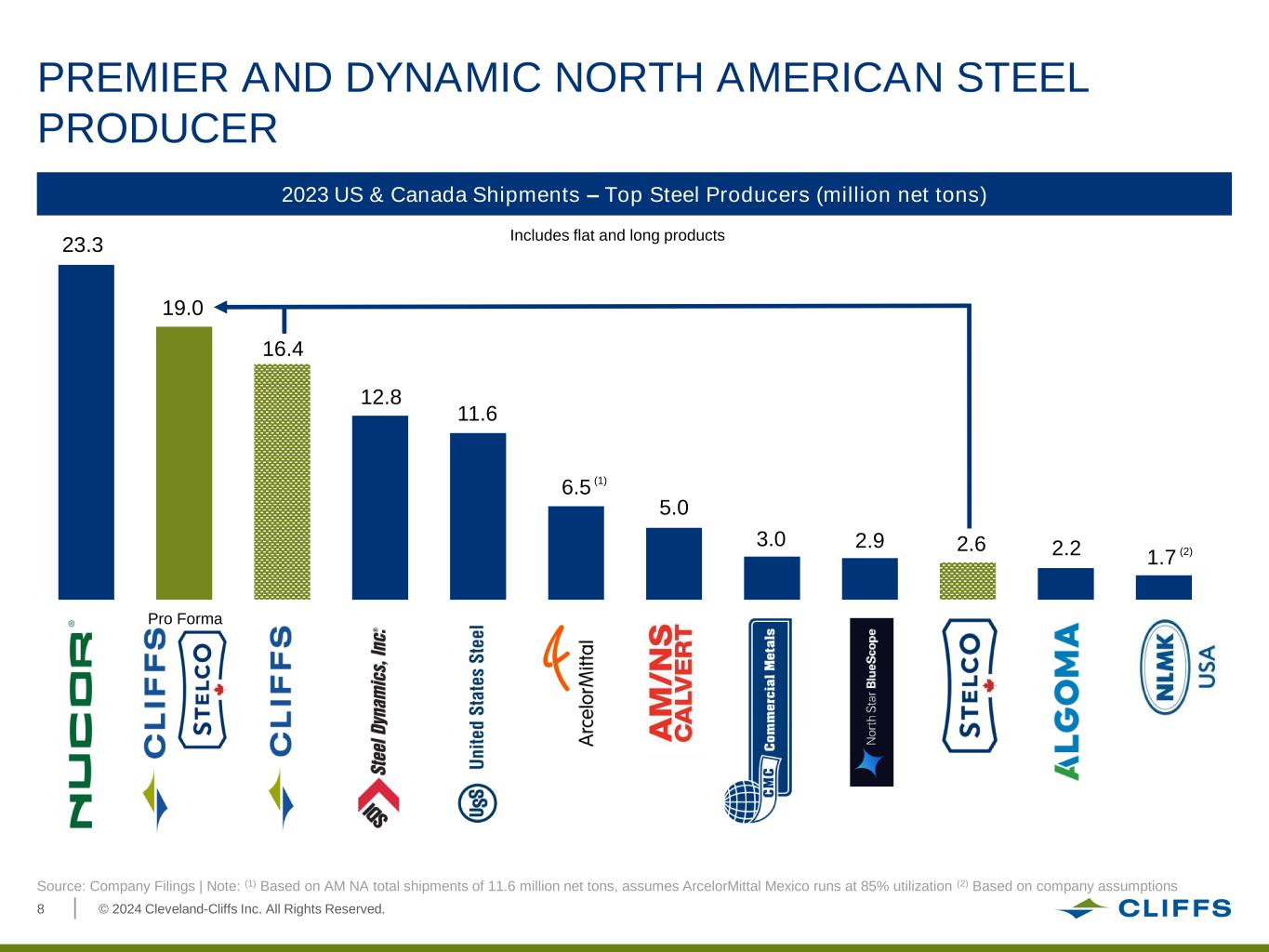

©2024 Cleveland-Cliffs Inc.所有权利保留。8首要和动态的北美钢铁生产商2023年皇冠体育官网和加拿大出货量-顶级钢铁生产商(净吨)233.3预估19.0 16.4 12.8 11.6 6.5来源:公司文件|注:(1)基于AM NA总出货量为1160万净吨,假设安赛乐米塔尔墨西哥公司的利用率为85%(2)基于公司假设3.0 2.9 2.6 2.2 1.7 5.0包括平板和长产品(1)(2)

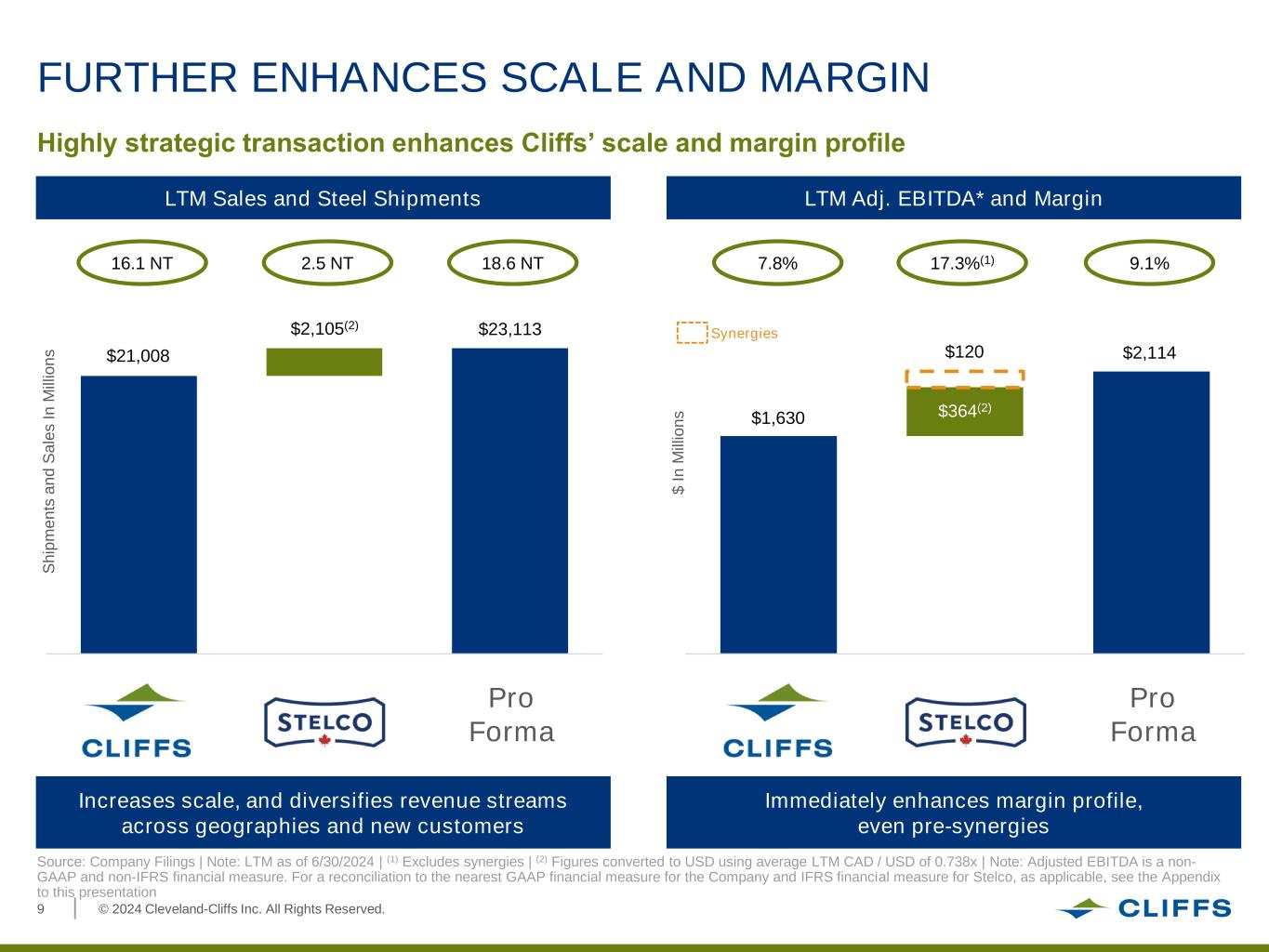

©2024 Cleveland-Cliffs Inc.资料来源:公司文件|注:截至2024年6月30日的LTM |(1)不包括协同效应|(2)使用LTM CAD / USD的平均0.738x转换为美元的数据|注:调整后的EBITDA是非公认会计准则和非国际财务报告准则的财务指标。如需对公司的GAAP财务指标和Stelco的IFRS财务指标(如适用)进行调整,请参见本报告附录LTM销售和钢材出货量LTM Adj. EBITDA*和利润率7.8% 17.3%(1)9.1%形式计算增加了规模,并使跨地区和新客户的收入流多样化,立即提高了利润率。增效前增效2,105美元(2)21,008美元23,113美元进一步提高规模和利润率高度战略性的交易提高了皇冠体育斯的规模和利润率状况协同增效效应:在这两项交易中,皇冠体育斯的规模和利润率进一步提高;在这两项交易中,皇冠体育斯的规模和利润率进一步提高;在这两项交易中,皇冠体育斯的规模和利润率进一步提高

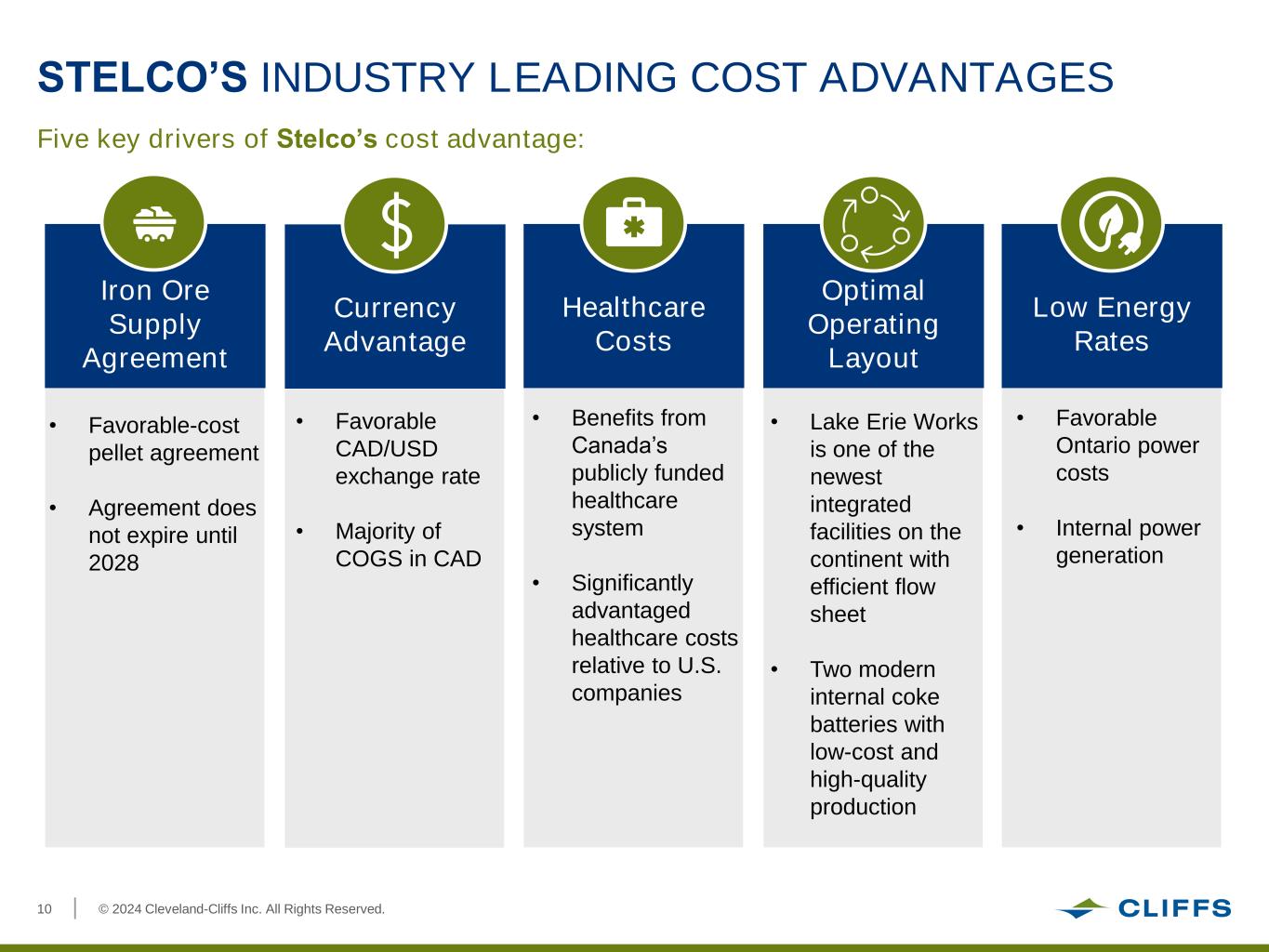

©2024 Cleveland-Cliffs Inc.STELCO行业领先的成本优势铁矿石供应协议STELCO成本优势的五个关键驱动因素:•有利的成本颗粒协议•协议将于2028年到期•货币优势医疗保健成本最佳运营布局低能源费率•有利的加元/美元汇率•加拿大的大部分COGS•受益于加拿大公共资助的医疗保健系统•相对于皇冠体育官网公司而言,具有显著优势的医疗保健成本•伊利湖工厂是非洲大陆上最新的综合设施之一,具有高效的流程表•两个现代化的内部焦炭电池具有低成本和低成本•有利的安大略省电力成本•内部发电

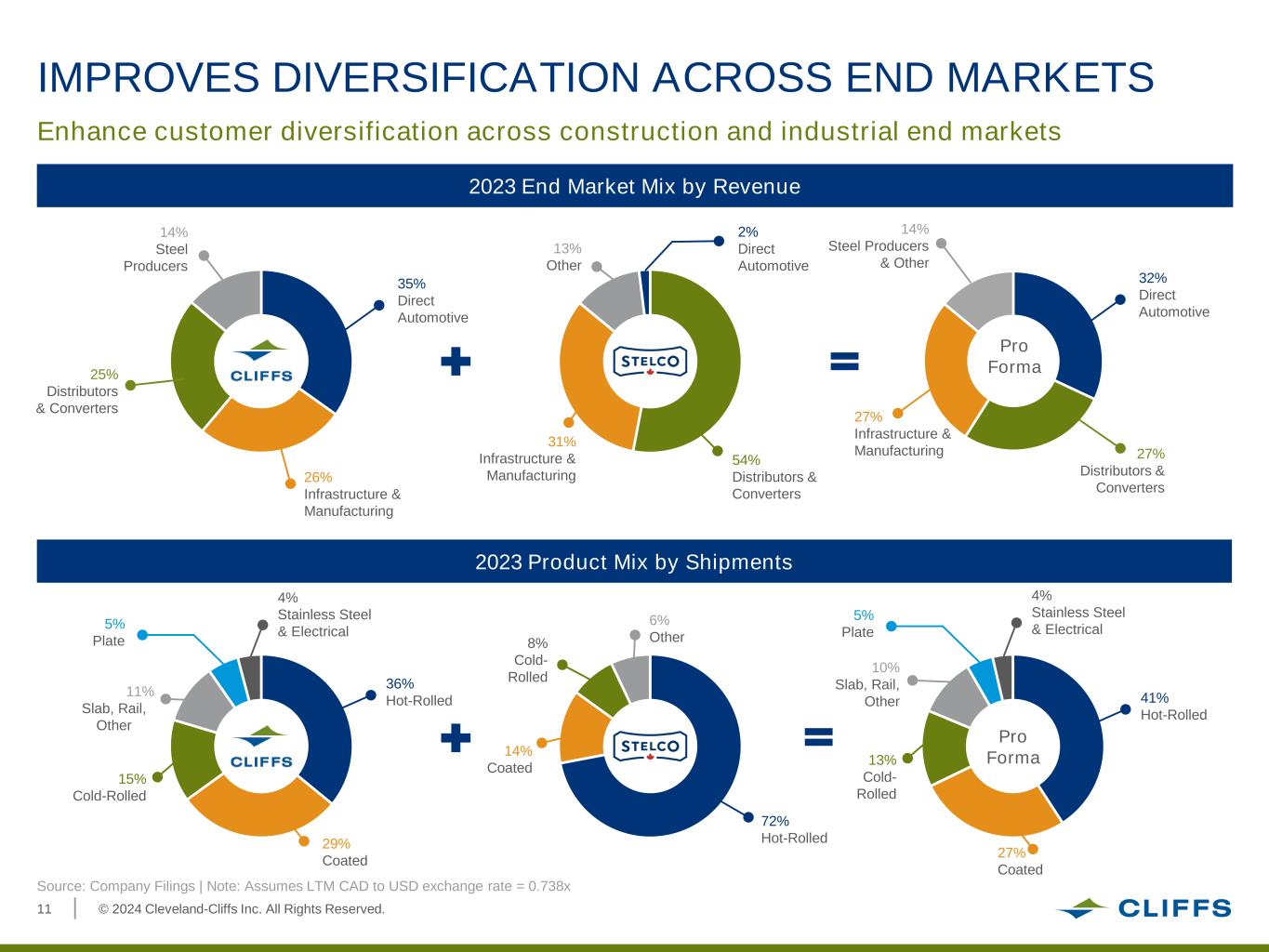

©2024 Cleveland-Cliffs Inc.2023年按出货量划分的终端市场产品组合2023年按收入划分的终端市场组合54%分销商和转换器31%基础设施和制造业13%其他2%直接汽车35%直接汽车26%基础设施和制造业25%分销商和转换器14%钢铁生产商形式5%平板11%平板,铁路,其他36%热轧15%冷轧29%涂布4%不锈钢和电气72%热轧14%涂布8%冷轧6%其他5%板材10%板坯,钢轨,其他41%热轧13%冷轧27%涂布4%不锈钢和电气增强建筑和工业终端市场的客户多样化32%直接汽车27%基础设施和制造业27%分销商和转换商14%钢铁生产商和其他形式来源:公司文件|假设加元兑美元汇率= 0.738x

©2024 Cleveland-Cliffs Inc.12预漆(JV) Stelco份额:130k吨/年高效的运营足迹垂直整合运营支持效率和高利润的形象L a ke ee e Ha m L到n Stelco工艺产生的可销售产品12 3 4 5 6 7 8 9预漆板冷轧全加工焦炭板热轧(酸洗)生铁热轧冷轧全硬涂(镀锌)焦炭电池容量:650k吨/年高炉容量:2.5 ntpa氧气顶吹转炉和双脚轮容量:3.1 ntpa生铁容量:1.0 ntpa带钢热轧机容量:3.7 ntpa式冷轧机容量:1.3 ntpa # 3镀锌容量:200 k ntpa z线容量:470 k ntpa批退火容量:200 k ntpa煤炭铁矿石和石灰岩石板可乐电池容量:675 k ntpa废锌1 3 4 5 6 78 9 9 2 1可口可乐可口可乐铁水熔铁板热-线圈热滚滚腌冷轧全硬酸洗线容量:0.9 ntpa来源:注:产能数字反映了每项生产资产的最大设计产能,不代表实际产量

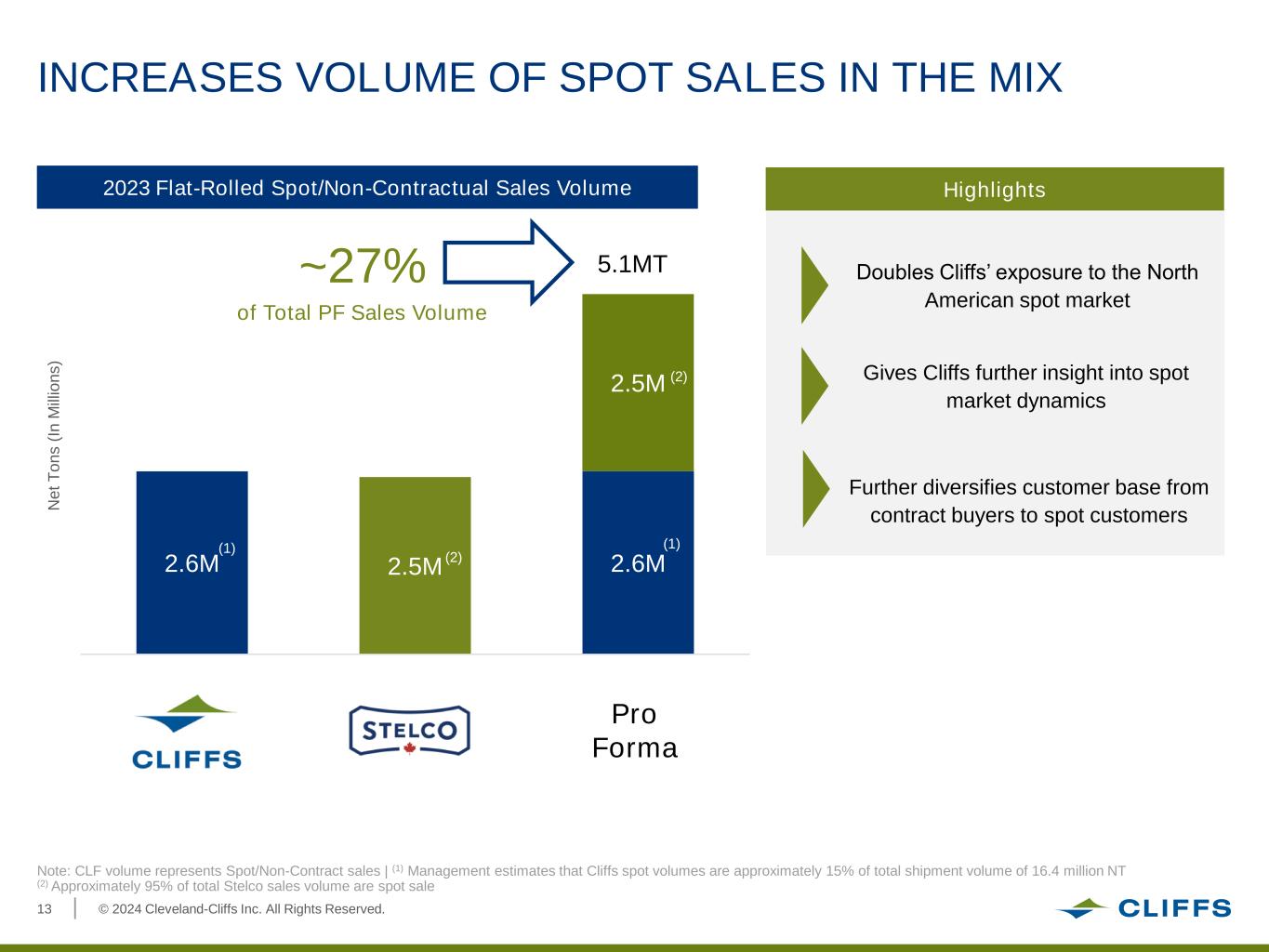

©2024 Cleveland-Cliffs Inc.2013年MIX现货销售量增加,扁轧现货/非合同销量进一步将客户基础从合同买家多样化为现货客户。CLF数量代表现货/非合同销售bbb(1)管理层估计,Cliffs现货数量约占总出货量1640万NT的15% (2)Stelco总销量的约95%为现货销售510万吨~总PF销量的27%亮点使Cliffs进一步了解现货市场动态2.6M 2.5M 2.6M 2.5M(2)(2)使Cliffs在北美现货市场的敞口增加一倍(1)(1)

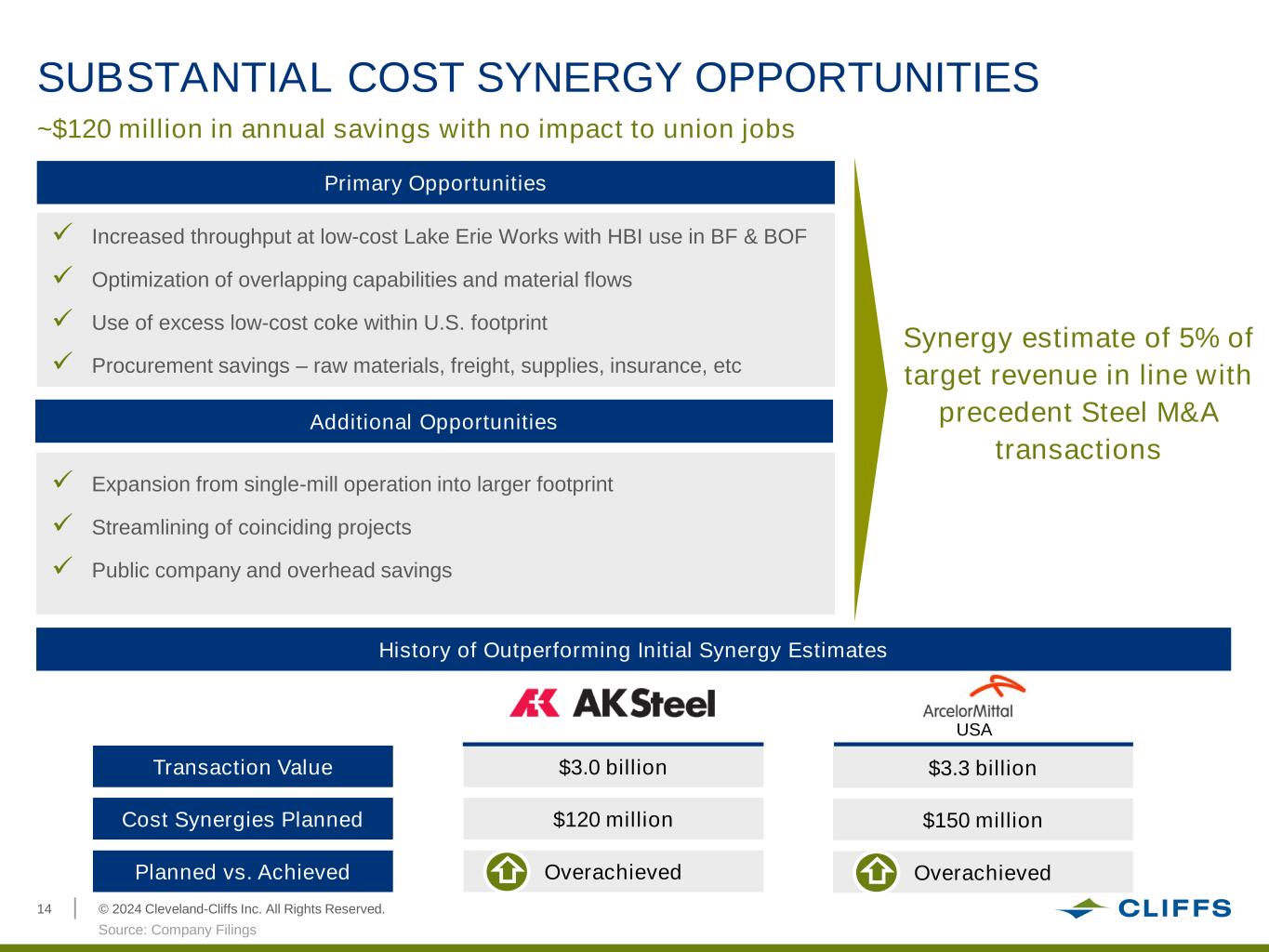

©2024 Cleveland-Cliffs Inc.14巨大的成本协同机会:每年节省1.2亿美元,且不影响工会工作主要机会✓在高炉和转炉中使用HBI,提高了低成本伊利湖工厂的吞吐量;优化了重叠的能力和物料流;在皇冠体育官网范围内使用多余的低成本焦炭;节省了采购费用——原材料、运费、用品、保险、上市公司和管理费用节省协同效应估计占目标收入的5%,与以往钢铁并购交易一致表现出色的历史初步协同效应估计来源:公司文件额外机会交易价值皇冠体育官网成本协同效应计划与已实现的协同效应计划与已实现的协同效应30亿美元1.2亿美元超额完成33亿美元1.5亿美元超额完成

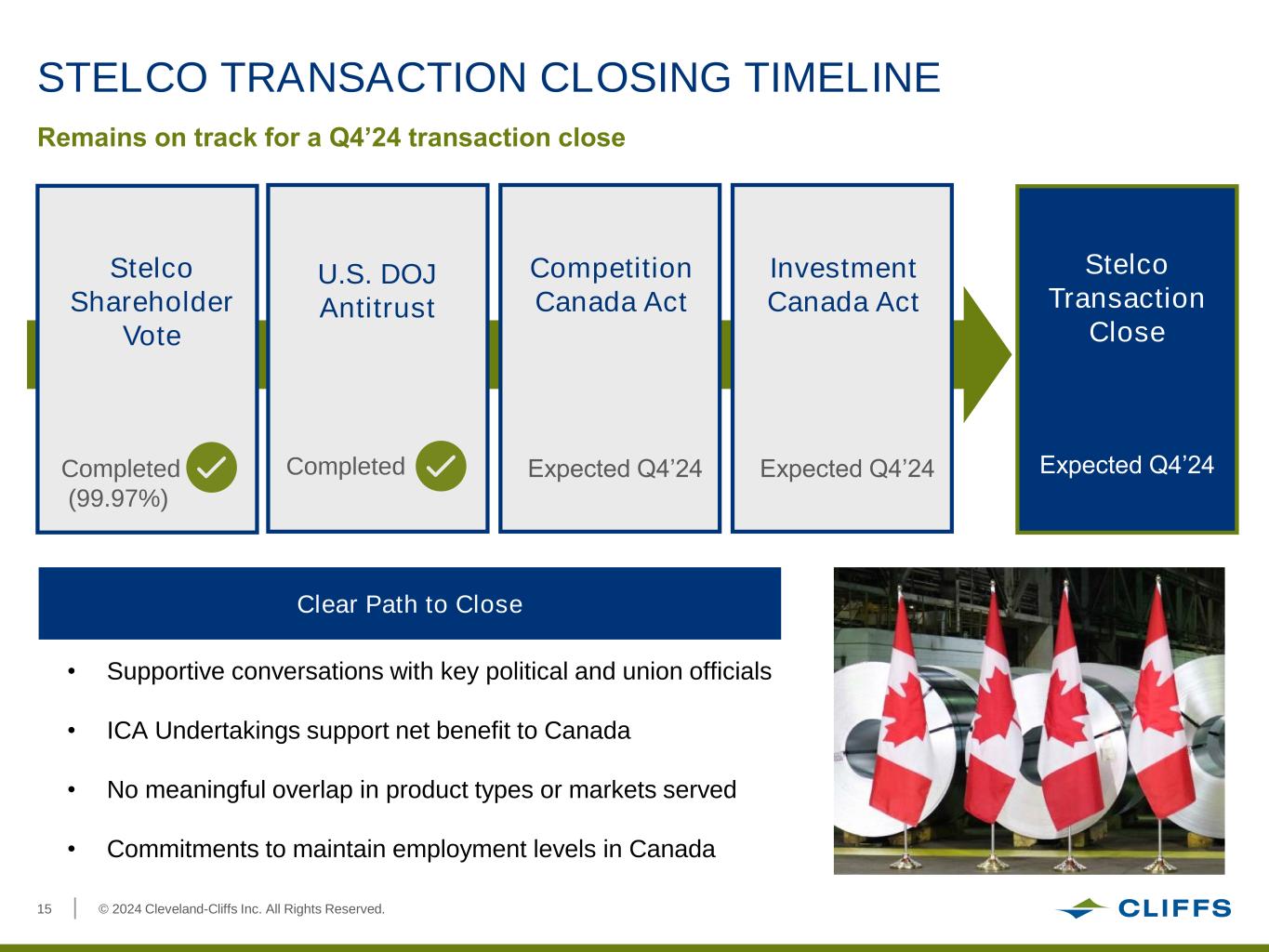

©2024 Cleveland-Cliffs Inc.STELCO交易完成时间表仍将按计划于24年第四季度完成皇冠体育官网司法部反垄断完成加拿大投资法预计24年第四季度STELCO股东投票完成(99.97%)STELCO交易完成预计24年第四季度完成清晰的完成路径•与主要政治和工会官员进行支持性对话•ICA承诺支持加拿大的净利益•在产品类型或服务市场上没有有意义的重叠•承诺保持就业水平加拿大竞争加拿大法案预计24年第四季度

皇冠体育-皇冠体育斯公司和财务概况

©2024 Cleveland-Cliffs Inc.首要任务继续降低成本,最大限度地发挥商业优势,推进增值项目,重新确定偿还债务的优先顺序机会性并购,成本同比大幅降低,预计到2025年将进一步降低成本,米德尔顿的EBITDA每年将提高6亿美元以上。在Stelco收购完成后,Butler & Weirton迅速去杠杆化资产负债表在2024年第四季度完成对Stelco的收购五个关键管理重点项目继续强调汽车市场,同时实现地域多元化

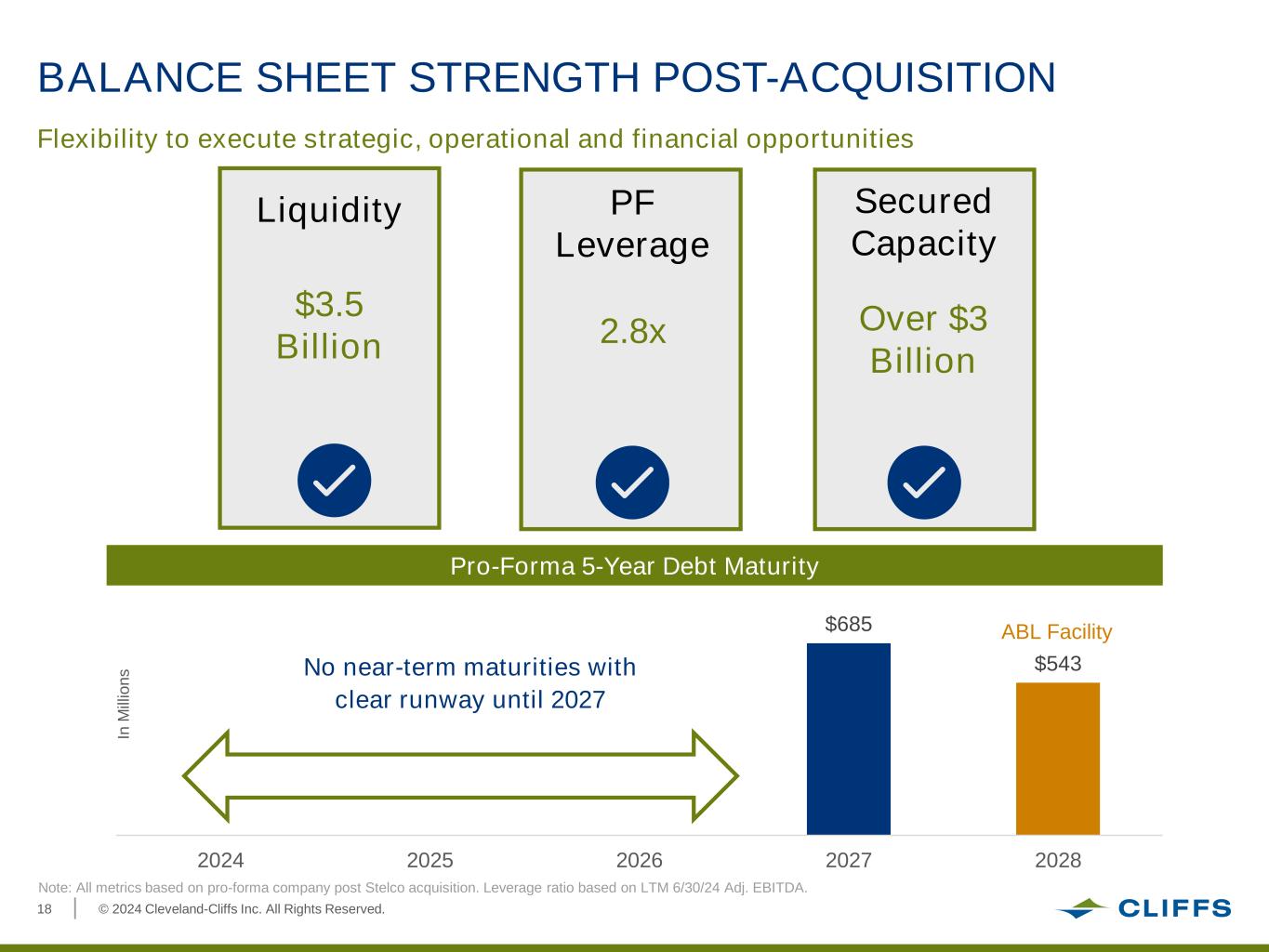

©2024 Cleveland-Cliffs Inc.18资产负债表实力收购后执行战略、运营和财务机会的灵活性PF杠杆流动性35亿美元28倍注:所有指标均基于收购Stelco后的公司预估。杠杆率基于LTM / 6/30/24和EBITDA。预估五年期债务到期日到2027年没有明确的短期期限,ABL在M ill ill的融资,其担保能力超过30亿美元

©2024 Cleveland-Cliffs Inc.cliff的独立资本支出降低2025年资本支出目标2025年资本支出目标2015年资本支出目标2015年资本支出目标6亿美元独立总资本支出更新战略资本时间表和精炼支出估算由于追赶维护周期减少持续资本支出避免与战略项目相关的持续资本支出包括Middletown的资本支出Butler和Weirton战略项目2021 2022 2023 2024E 2025E $705 $943 $646 $675 $100 $500战略项目维持600美元重大维修和维护周期完成目标2025

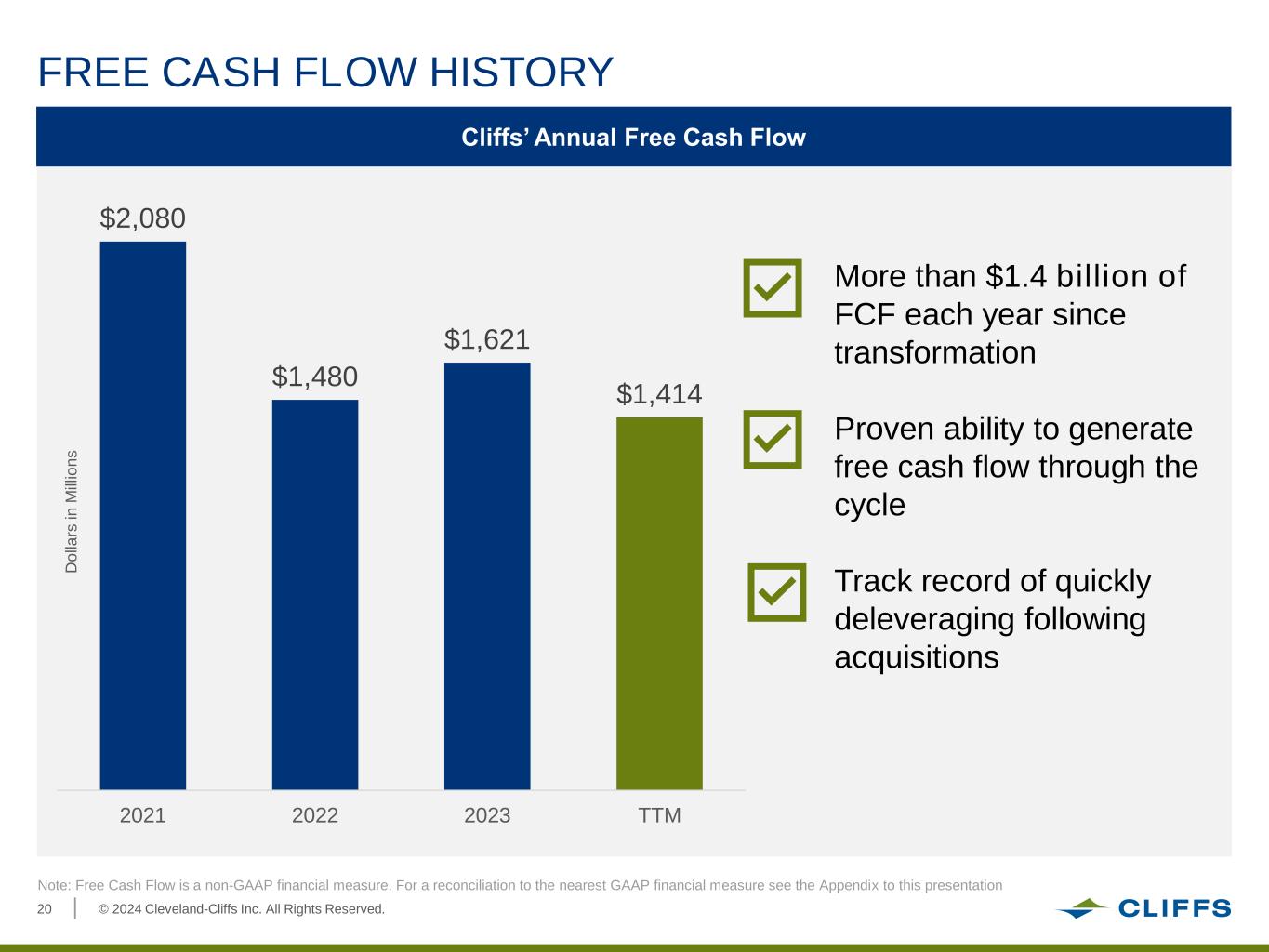

©2024 Cleveland-Cliffs Inc.皇冠体育斯年度自由现金流自由现金流历史自转型以来每年超过14亿美元的自由现金流通过周期产生自由现金流的能力经过验证收购后快速去杠杆化的记录注:自由现金流是非公认会计准则财务指标。为和解到最近的公认会计准则财务指标见附录本课程2080美元1480 1621 1414 2021 2022 2023 TTM D o lla rs io n s n M生病

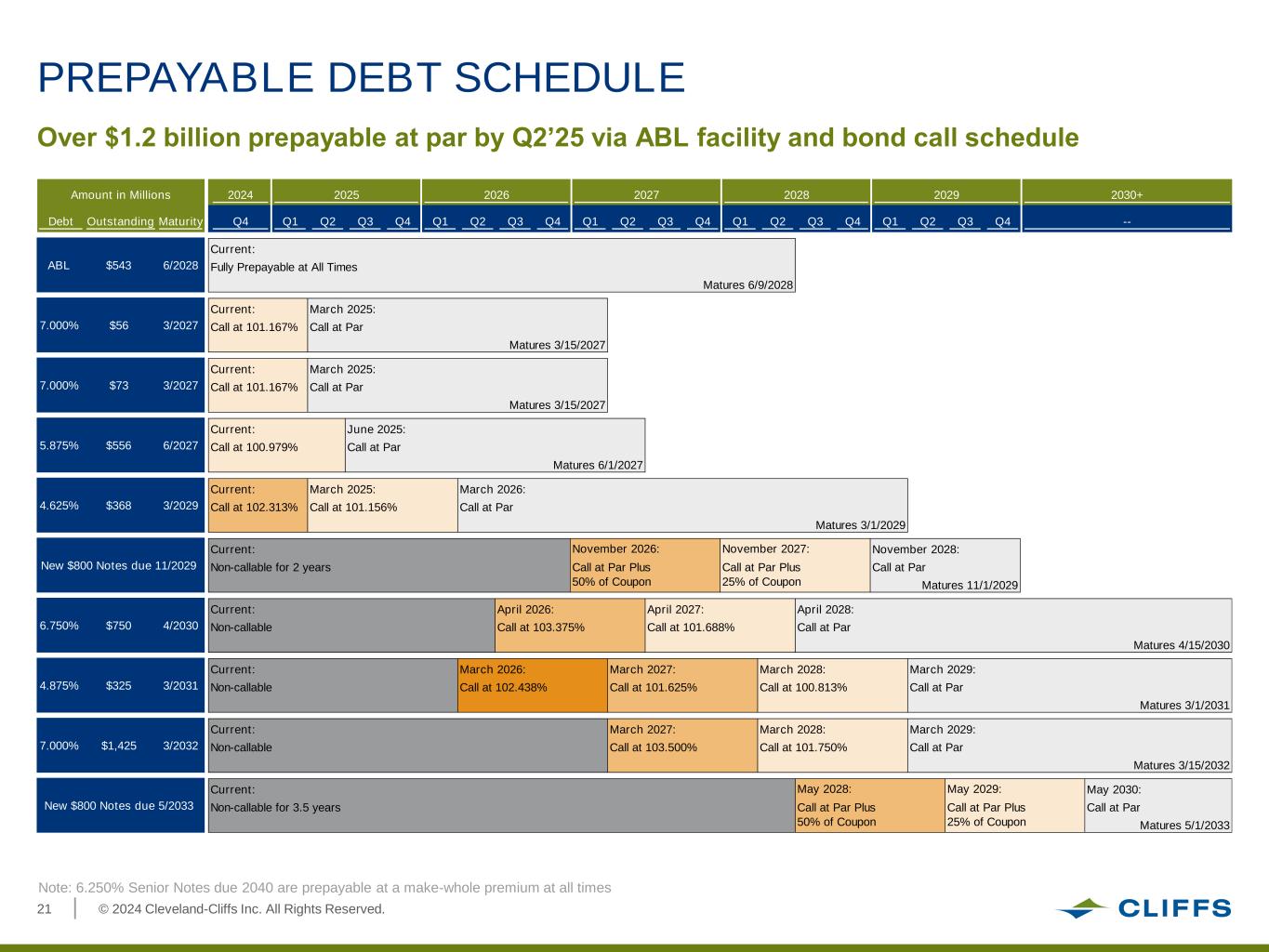

©2024 Cleveland-Cliffs Inc.所有权利Reserved.21 PREPAYABLE债务安排金额数百万2024 2025 2026 2027 2028 2029 2030 +未偿债务到期Q1 Q2第三季度第四季度Q1第四季度第三第四季度Q1第三季度第四季度Q1第三第四季度Q1第三季度第四季度——当前:完全PREPAYABLE随时成熟6/9/2028电流:2025年3月:叫101.167%叫平价成熟3/15/2027电流:2025年3月:叫101.167%叫平价成熟3/15/2027电流:2025年6月:叫100.979%叫平价成熟6/1/2027电流:2025年3月:2026年3月:102.313% 101.156% Par到期2029年3月1日现期:2028年11月:2年期不可赎回Par到期2029年11月1日现期:2026年4月:2027年4月:2028年4月:不可赎回103.375% Par到期101.688% Par到期2030年4月15日现期:2026年3月:2027年3月:2028年3月:2029年3月:不可赎回102.438%面值101.625%面值100.813%面值到期2031年3月1日现期:2027年3月:2028年3月:2029年3月:2032年3月15日到期日:2030年5月:3.5年期票面赎回赎回权到期日:2033年5月:2028年5月:2029年5月到期的新800美元票面赎回权加50%票面赎回权加25%票面赎回权3/2031$3254.875% 3/2032$1,4257.000% 556 /2027 4.625% $368 /2030$7506.750% 2029年3月2026年11月:2027年11月:2029年11月到期的800美元新票据ABL $543 /2028以票面价加25%票面价加50%票面价赎回7.000% $56 /2027 7.000% $73 /2027 5.875%通过ABL工具和债券赎回计划,到25年第二季度按票面价预付超过12亿美元注:2040年到期的6.250%优先票据在任何时候都以全额溢价偿还

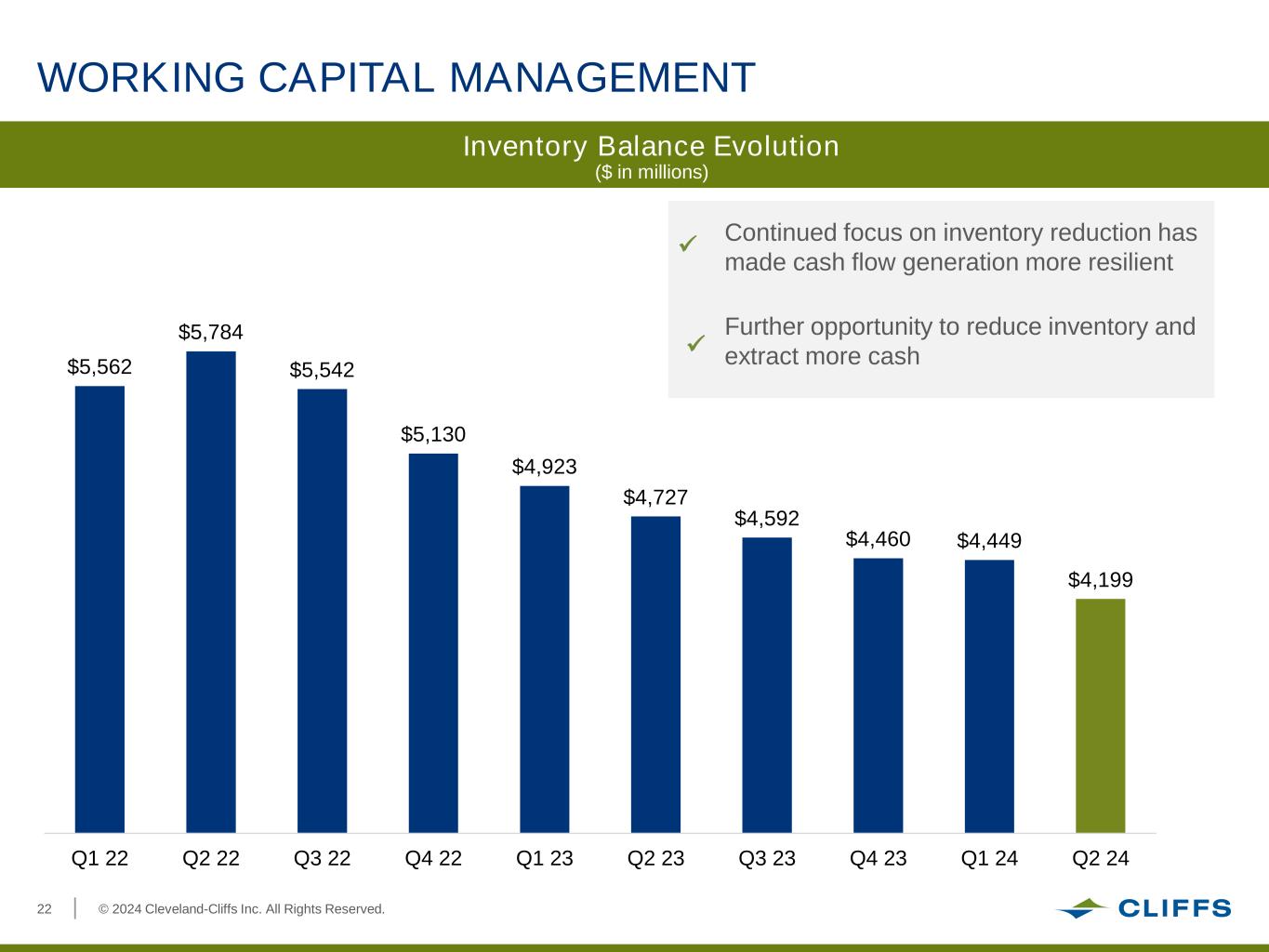

©2024 Cleveland-Cliffs Inc.营运资金管理库存余额演变(百万美元)5,562美元5,784美元5,542美元5,130美元4,923美元4,727美元4,592美元4,460美元4,449美元4,199 Q1 22第二季度22 Q3 22 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 Q2 24继续关注库存减少,使现金流产生更具弹性。进一步有机会减少库存并提取更多现金

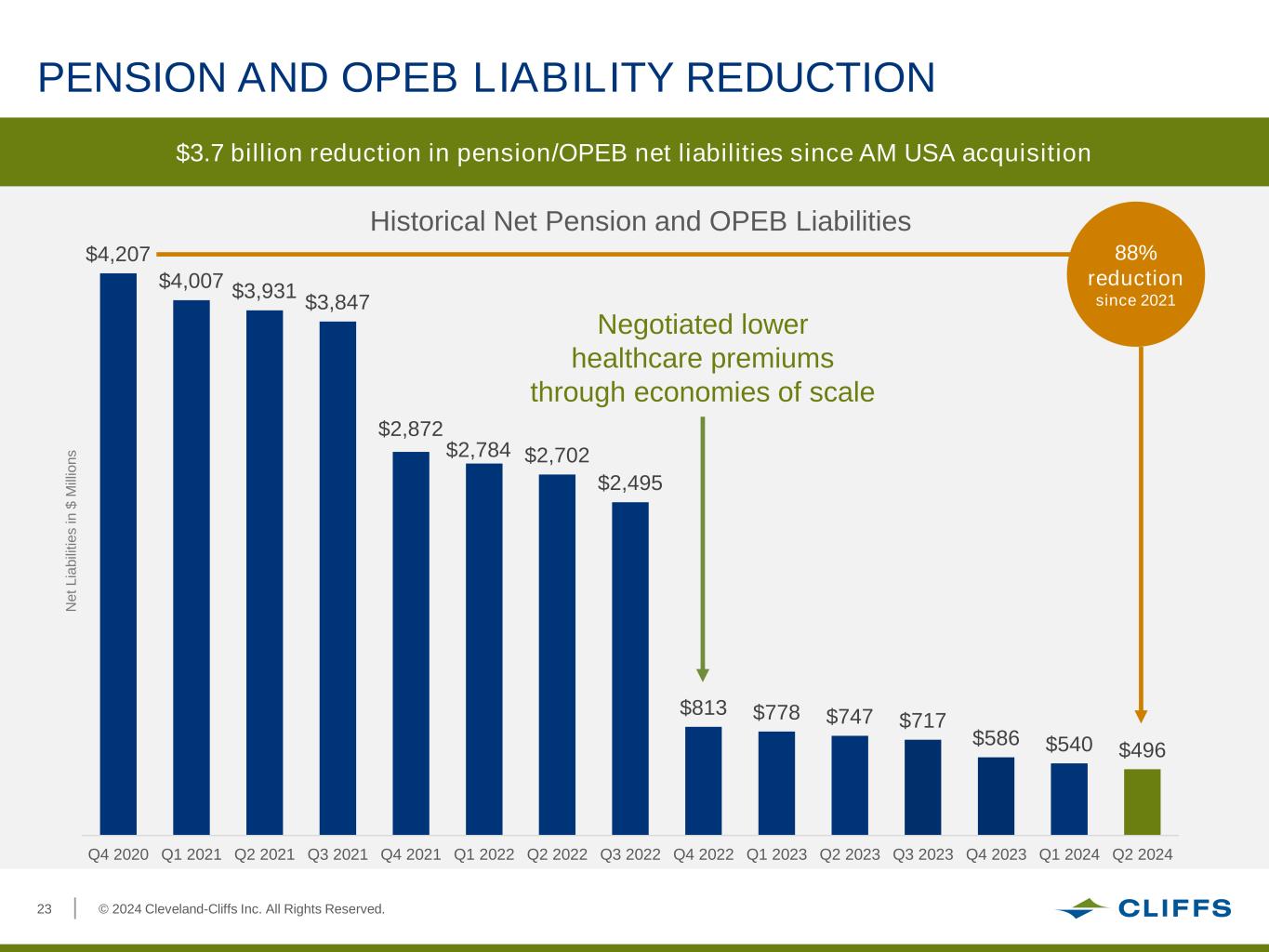

©2024 Cleveland-Cliffs Inc.所有权利Reserved.23 4207 4007 3931美元3847美元2872美元2784美元2702美元2495美元813美元778美元717美元586美元540美元747美元496第四季度2020 Q1 2021 Q2 2021第三2021年第四季度2021 Q1 2022 Q2 2022第三2022年第四季度2022 Q1 2023 Q2 2023第三2023年第四季度2023 Q1 2024削减养老金和OPEB债务2024年第二季度以来37亿美元减少养老金/ OPEB净负债是皇冠体育官网收购N e t L ia b伊犁ti e s N M美元生病io N s减少88%自2021年以来历史养老金和OPEB债务净协商降低医疗费用通过规模经济

©2024 Cleveland-Cliffs Inc.米德尔顿工厂- DRI工厂和电熔炼炉低碳排放不影响产品质量净资本成本1能源部授予年度成本节省13亿美元5亿美元4.5亿美元预计完工2029年用最先进的DRI- emf结构替换高炉1现有高炉和焦炭工厂的政府资助和资本规避1阶段:合同谈判,工程,许可证准备,初步现场准备(1年)第二阶段:详细设计,批准许可证,现场工作(1年)第三阶段:建筑和设备安装。DRI/ emf的制造和交付(27个月)阶段4:调试、启动和提升活动

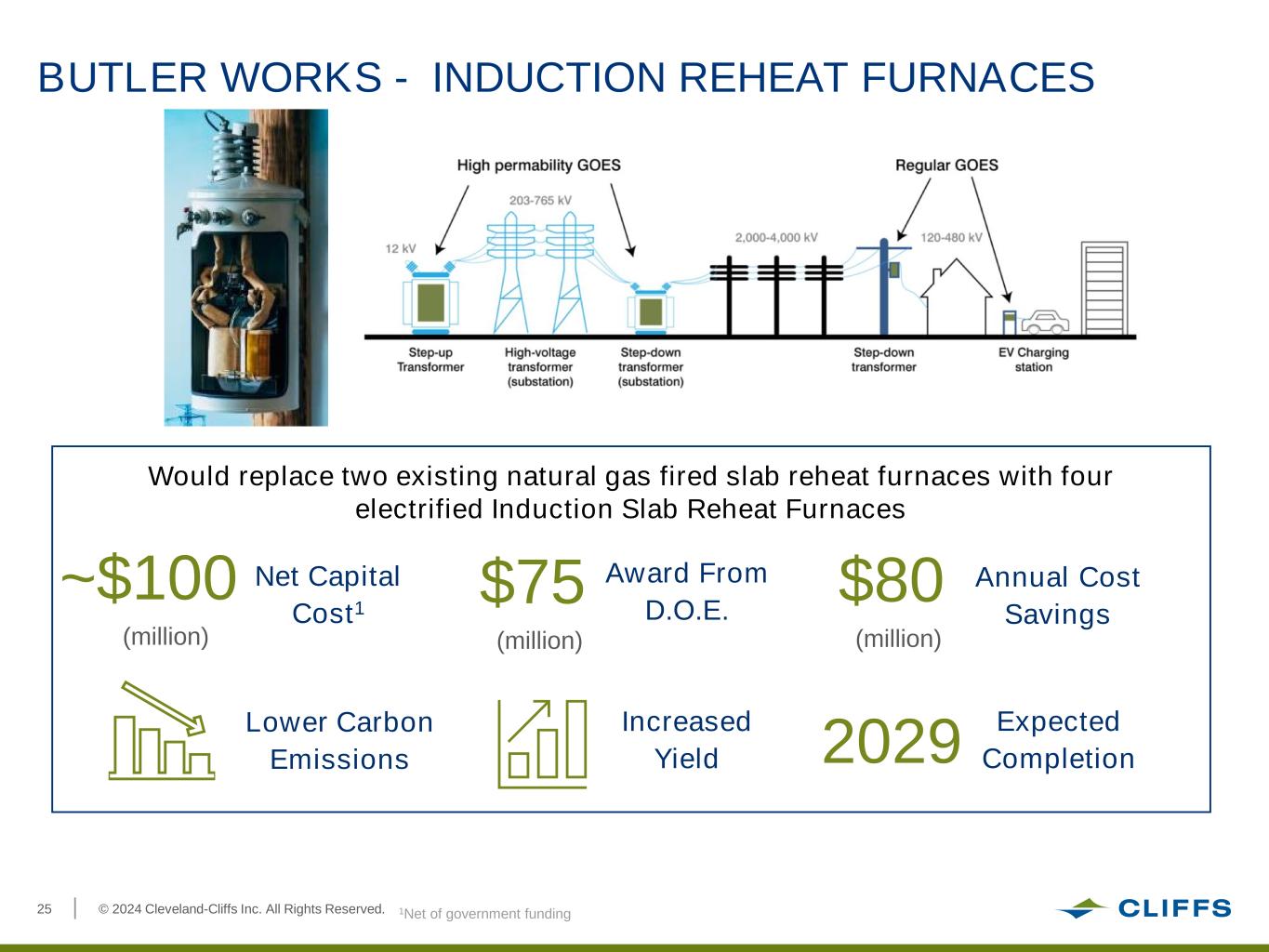

©2024 Cleveland-Cliffs Inc.巴特勒工厂-感应再热炉降低碳排放增加收益净资本成本1能源部授予年度成本节约约1亿美元7500万美元8000万美元将用4台电气化感应再热炉取代现有的2台天然气燃烧的板坯再热炉预计在2029年完工,政府资金净额

©2024 Cleveland-Cliffs Inc.下游变压器生产公司WV被选为配电变压器生产厂的生产基地净投资1亿美元,预计将得到西弗吉尼亚州经济发展局5000万美元的支持,为600名剩余下岗员工提供再就业机会将生产三相配电变压器,以支持供应严重不足的市场对皇冠体育斯巴特勒钢铁厂生产的皇冠体育官网产GOES的需求增加变压器生产厂

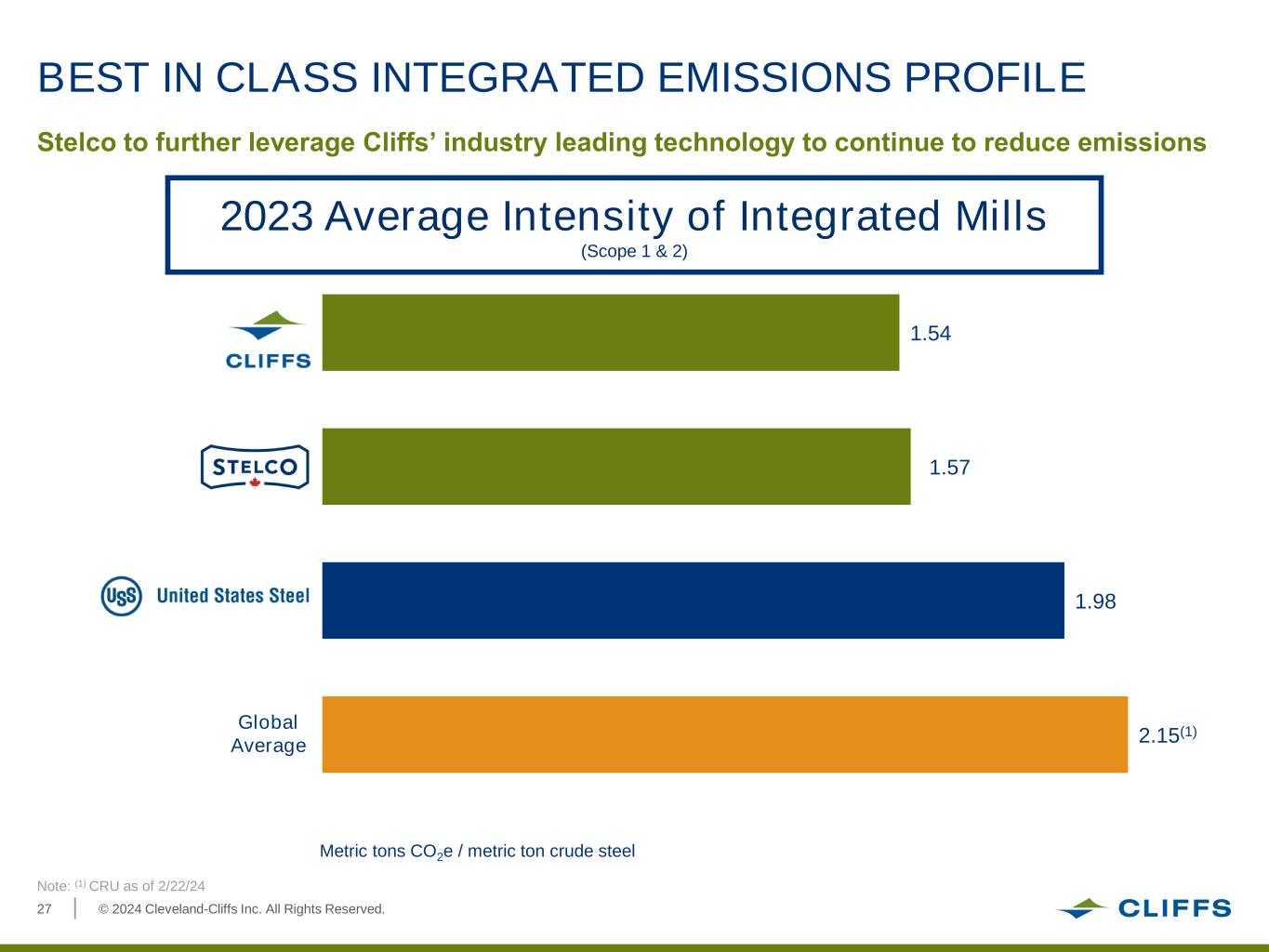

©2024 Cleveland-Cliffs Inc.同类最佳综合排放概况2.15(1)1.98 1.57 1.54全球平均Stelco进一步利用Cliffs的行业领先技术继续减少排放注:(1)截至2023年2月22日的CRU综合钢厂平均强度(范围1和2)公吨二氧化碳当量/公吨粗钢

©2024 Cleveland-Cliffs Inc.所有权利Reserved.28 10 15 20 25 30 40 35 45 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020钢铁研究协会,LLC废废模型与悬崖分析主要供应已经缩小了50多年'废钢供应(包括返回废钢)P ri m e S c ra P S u P P ly我n m生病io n G ro S T o n年代因素萎缩主要供应总体制造业外包提高收益率

附录

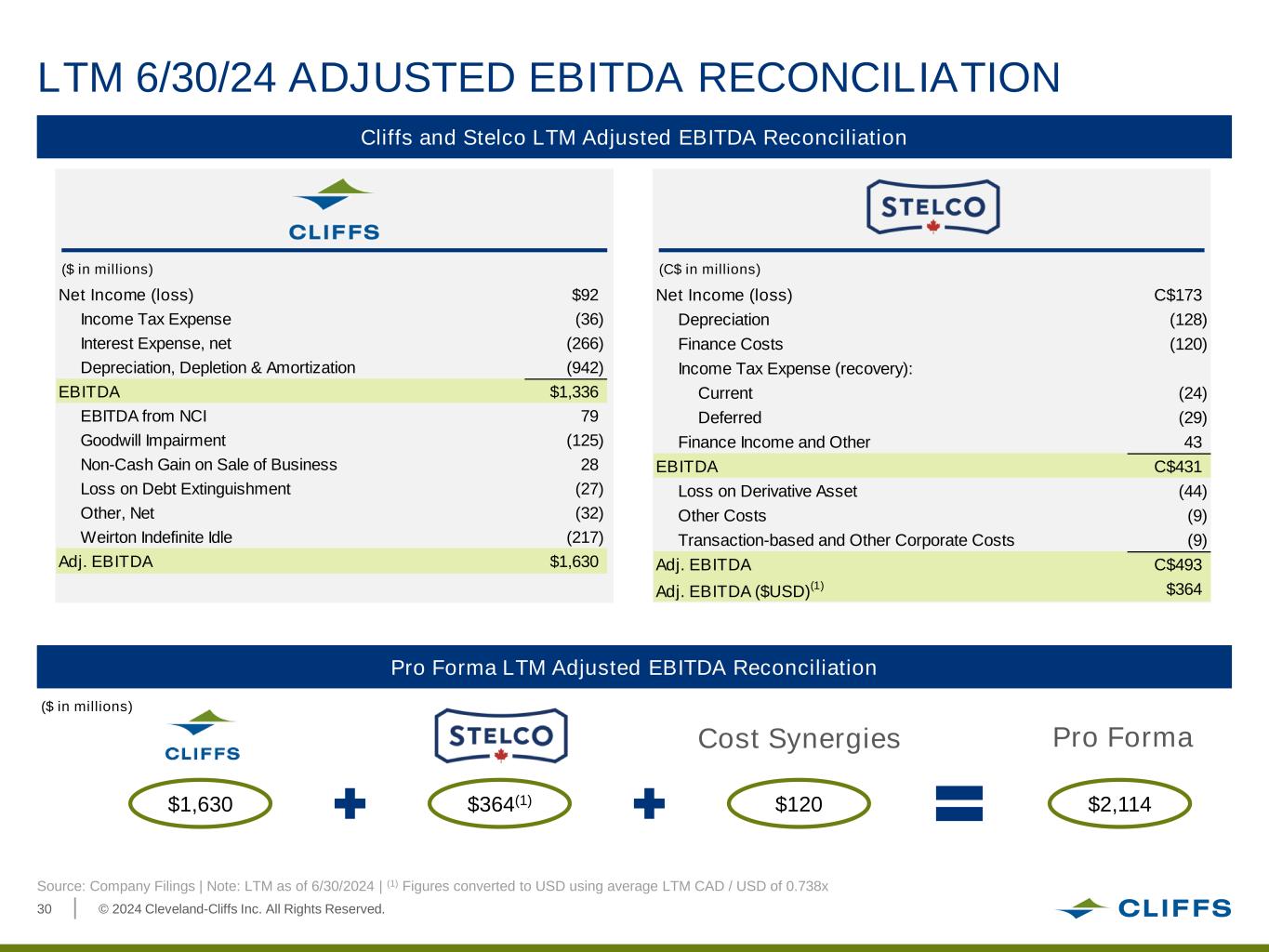

©2024 Cleveland-Cliffs Inc.资料来源:公司文件|注:LTM截至2024年6月30日|(1)数据转换为美元,使用平均LTM加元/美元0.738x形式LTM 6月30日调整后EBITDA调节净收入(亏损)加元173加元折旧(128)财务成本(120)所得税费用(回收):当期(24)递延(29)财务收益及其他43 EBITDA C$431衍生品资产亏损(44)其他成本(9)交易及其他公司成本(9)EBITDA C$493 adj EBITDA(美元)(1)$364净收入(亏损)$92所得税费用(36)利息费用,净(266)折旧、损耗及摊销(942)EBITDA来自NCI的EBITDA $1,336商誉减值(125)出售业务非现金收益28债务清偿损失(27)其他,净(32)韦尔顿无限期闲置(217)Adj. EBITDA 1,630 cliff和Stelco长期资产调整后的EBITDA对账(百万美元)(百万美元)1,630形式长期资产调整后的EBITDA对账$364(1)$2,114成本协同效应(百万美元)$120

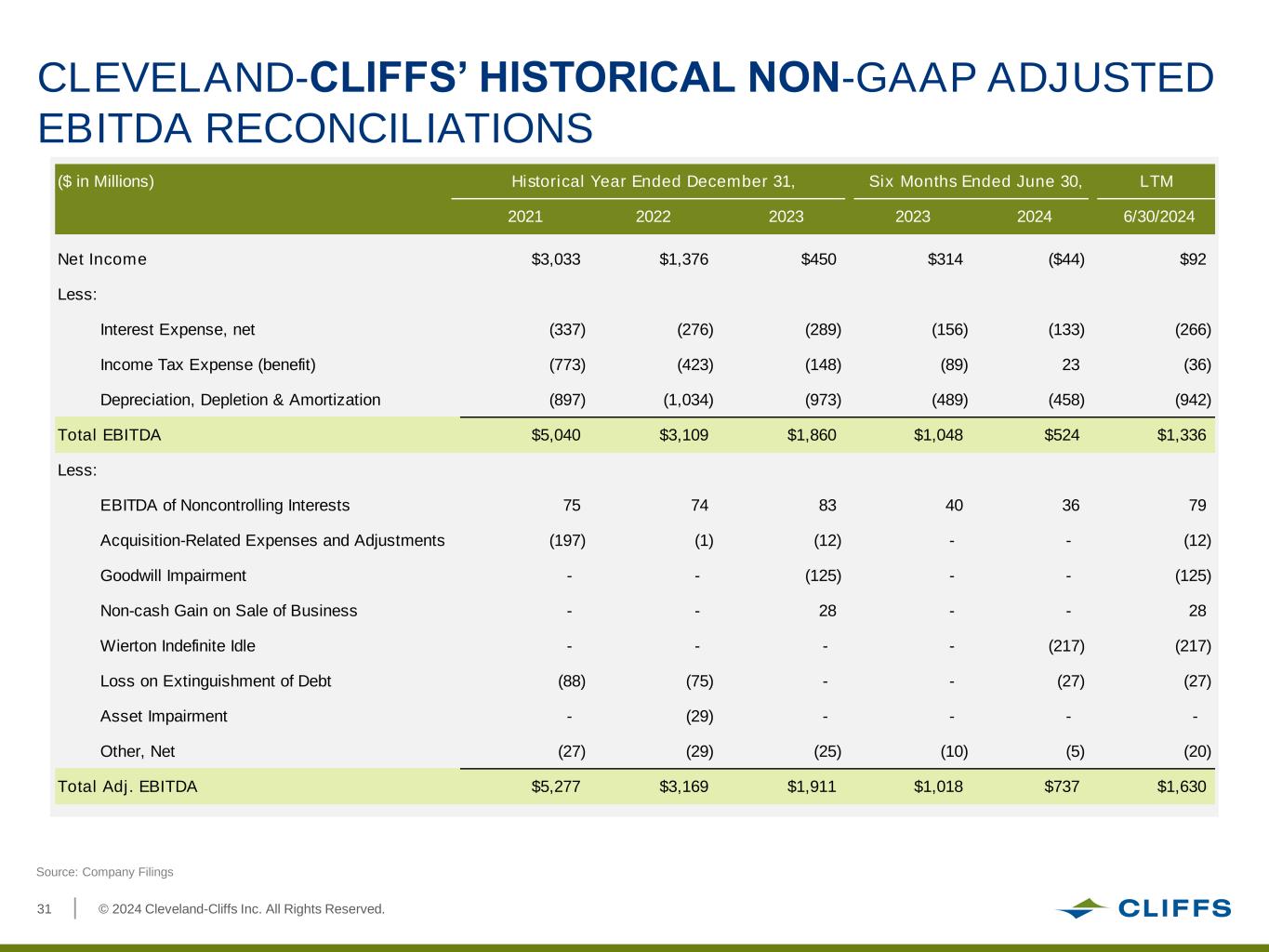

©2024 Cleveland-Cliffs Inc.资料来源:公司文件(百万美元)截至2021年12月31日的历史年度,截至2021年6月30日的六个月,LTM 2021年2022年2023年2023年2024年6月30日净收入3,033美元1,376美元450美元314美元(44美元)$92减:利息费用净额(337)(276)(289)(156)(133)(266)所得税费用(收益)(773)(423)(148)(89)23(36)折旧、损耗和摊销(897)(1,034)(973)(489)(458)(942)EBITDA总额5,040美元3,109美元1,860美元1,048美元524美元1,336减:无控利益的EBITDA 36 75 74 83 79与收购相关的费用以及调整(197)(1)(12)——(12)商誉减值- -(125)-(125)非现金获得销售的业务——28 - - 28 Wierton不定闲置 - - - - ( 217)(217)损失偿清的债务(88)(75)——(27)(27)资产减值(29 ) - - - - 其他,净(27)(29)(25)(10)(5)(20)的总轮廓分明的EBITDA 5277 3169 1911美元1018美元737美元1630美元

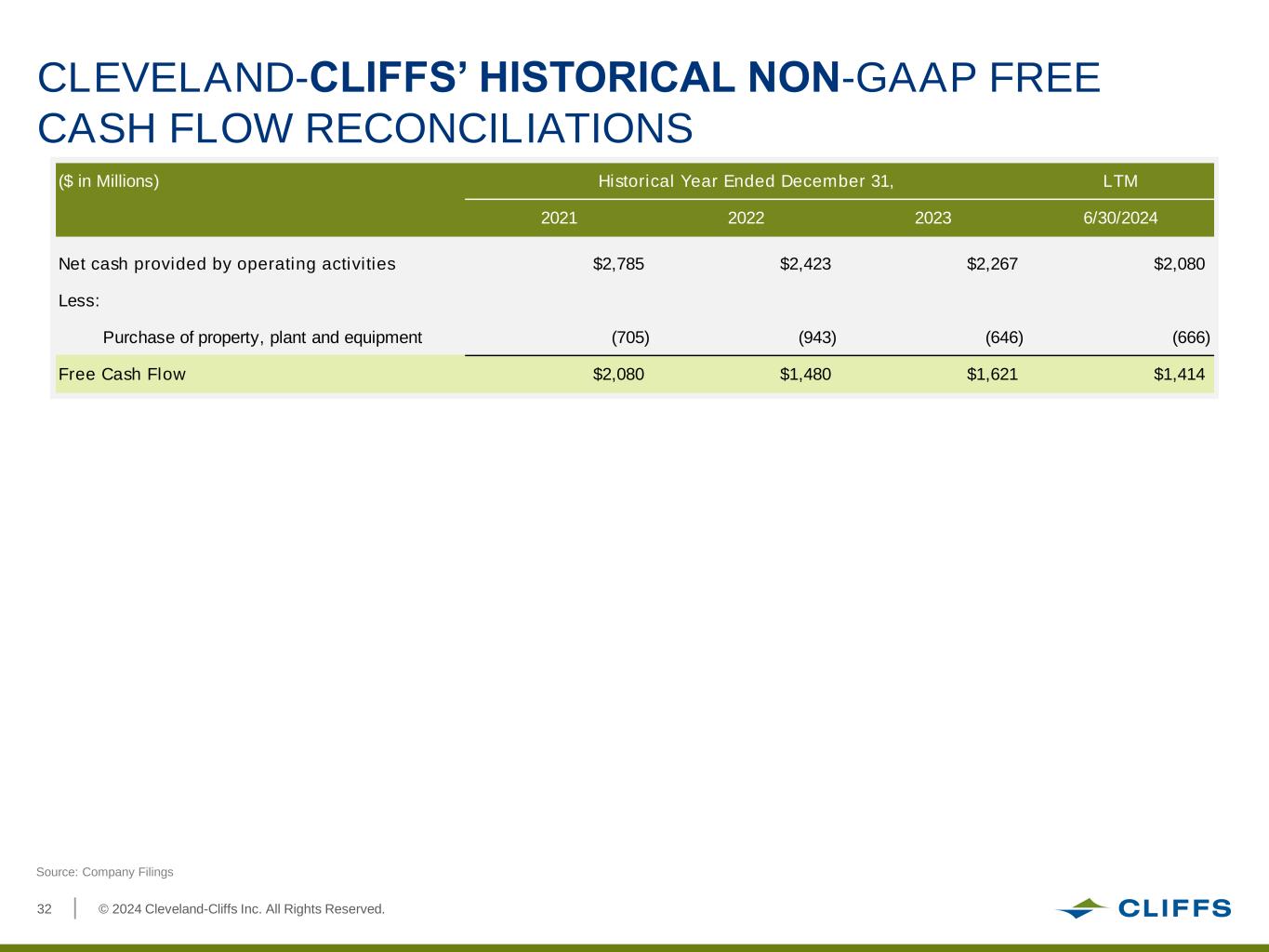

©2024 Cleveland-Cliffs Inc.皇冠体育-克利夫斯历史非公认会计准则自由现金流调节资料来源:公司文件(百万美元)截至2021年12月31日的历史年度,LTM 2022年2023年6月30日经营活动提供的净现金2,785美元2,423美元2,267美元2,080减去:购买财产,工厂和设备(705)(943)(646)(666)自由现金流2,080美元1,480美元1,621美元1,414

©2024 Cleveland-Cliffs Inc.版权所有。